Call Sales: +1 (833) 437-3835

Call Sales: +1 (833) 437-3835

Revel | January 31, 2018 |

The past year brought along a flurry of disruption to the payments world. From cryptocurrency to peer to peer payments – how, where, and when people are paying is changing.

One important development is the slow demise of cash. Across the country, both restaurants and retail shops have begun experimenting with removing the option to pay with cash. But before we speak to tales of a cashless society, let’s take a look at the pros and cons of businesses going cashless today.

Increase Speed of Service

As more and more counter service and fast casual spots pop up – the demand for a faster, more convenient in-store experience is increasingly prevalent.. By going cashless you would reduce friction by getting rid of the time spent paying with cash and giving change back.

Strengthen Security

Cash boxes are a prime target for thieves. By not having cash lying around at your business you are reducing the risk of being robbed, including from your own employees!

Easier Bookkeeping

Reconciling cash at the end of the day is time consuming and leaves room for human error. These administrative costs can have an effect on your bottom line. While on the other hand, credit and debit cards transactions automatically reconcile with your bank, keeping you on top of your financials in real-time.

Data Gathering

It’s much easier to collect customer data and make sense of that data when customers pay by card. By tracking this data, merchants can track purchasing behavior, segment their customers, and personalize rewards based off of their purchasing history.

Alienates Customers

The reality is that people still carry cash, and more so, people want to use cash for certain purchases. While the use of cash is waning, the fact is that Americans still use cash for around 14% of their everyday purchases.

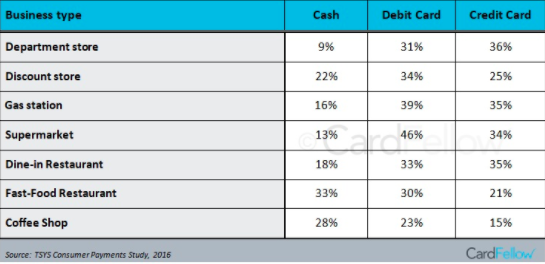

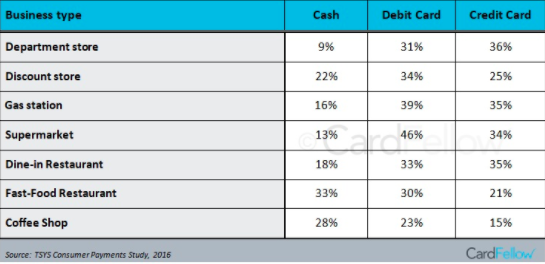

Tysys breaks down where cash is being used compared to debit and credit cards:

When evaluating whether to go cashless, it’s important to see how cash is being used in your area of business. One clear pattern is that as products and services get more expensive, customers are more likely to use card over cash.

Higher Fees

Businesses have to pay a fee per credit card transaction, and in response many tack on an additional fee to the consumer to offset the transaction cost. For customers that prefer to pay with cash, this can turn them off to doing business with you.

While there isn’t one clear answer, it’s more important than ever to provide your customers with multiple payment options. With Revel Systems iPad POS System you can cater to digital savvy customers with mobile wallet technology, easily split bills, and provide credit card preauthorization.