Call Sales: +1 (833) 437-3835

Call Sales: +1 (833) 437-3835

Revel | September 7, 2017 |

Credit card processing can be one of the most complex and confusing parts of running a business. And whether you are opening your first business, or looking for a new payment processor, the integrity of your business depends on how efficiently, and securely you can process consumers’ transactions.

When getting started it is helpful to look at the terminology that will be guiding your decision-making.

The first step is to identify what a payment processor is. As defined by Kabbage, a payment processor is a company that handles transactions so that your customers can buy your products. That means the payment processing company communicates and relays information from your customer’s credit or debit card to both your bank and your customer’s bank.

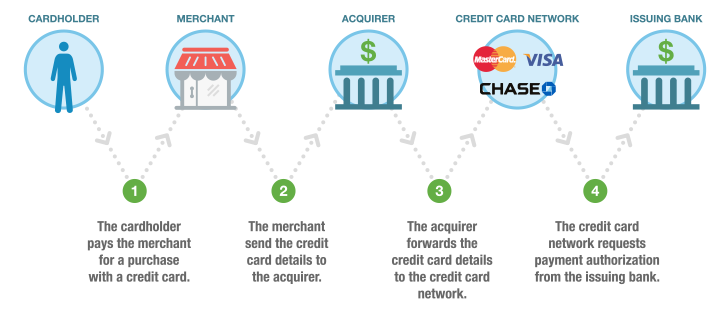

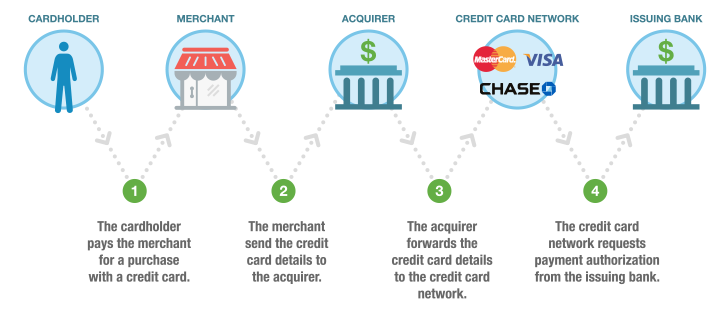

So let's start with the players in the payment processing process.

Merchant: The business owner.

Cardholder: The customer authorized to use the credit card.

Acquirers: The business owner’s bank that processes the credit card transactions.

Issuers: This is the credit union that issues the credit card to the consumer. (eg. VISA, Mastercard, etc.)

See it in action!

Now, that the major players are outlined. What is involved in payments processing?

Payment Gateway: The technology that transfers payment information from the merchant to acquirer.

Batch: Processing the authorized credit card transaction information to the credit card Acquirer at close of business to be settled to the merchant’s bank account.

Chargeback: A cardholder can file a dispute for a credit card transaction. Then, the Issuer will investigate the complaint. If the cardholder's complaint is proven true, the bank will refund the cardholder and apply an additional fee to the merchant.

Clearing: Transferring financial transaction information between an acquirer and an issuer to facilitate the posting of a cardholder's account and reconciliation of a customer's settlement position.

Reserve account: When a chargeback occurs, part of the revenue from a merchant's credit card transactions is held in reserve by the merchant account provider to cover possible disputed charges or chargeback fees.

Once, you’ve got the terminology down you can begin your search for the right merchant service provider.

Interested in a payments processor with competitive market pricing that works with the latest in Point of Sale technology? Learn more about Revel Systems payments solution for your business.