Call Sales: +1 (833) 437-3835

Call Sales: +1 (833) 437-3835

Revel | January 8, 2016 |

Welcome to a new year everyone! A new year also means the start of tax season. Okay, maybe it’s not as exciting as new goals and resolutions you have planned for yourself or your business, but it is something we all have to do.

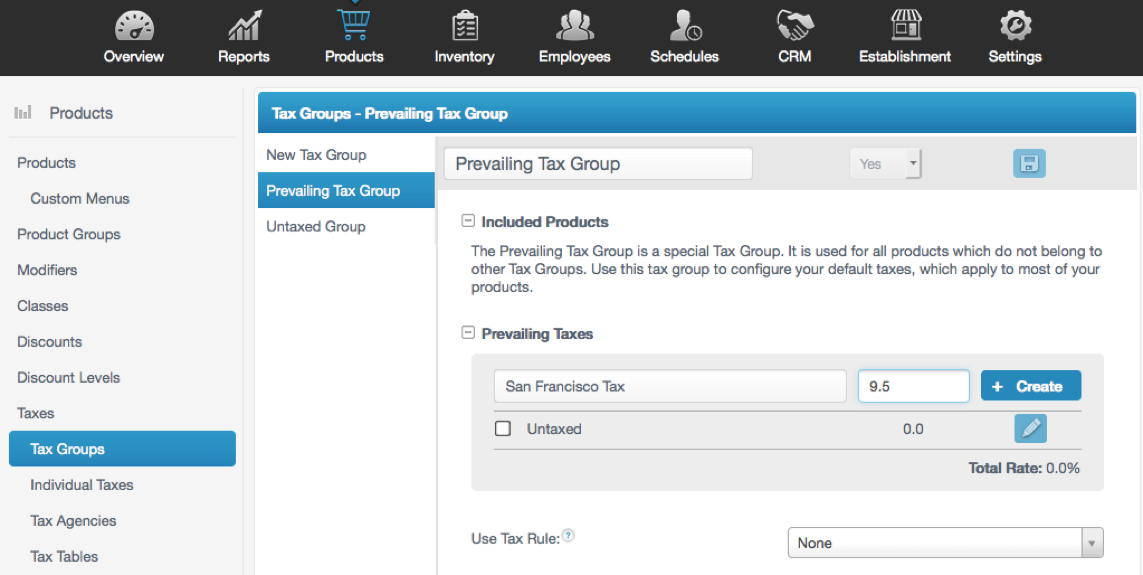

If you ever had trouble setting up taxes on your Revel POS or you just bought yourself a new Revel System to start the new year, then we have the tech tip just for you! Let's talk about setting up taxes. The first thing you will have to do is set up a Prevailing Tax, or "default tax," that is applied to all your products at the time of the order or transaction. To set it up is really simple. Simply log in to your Revel Management Console from the iPad POS, then select the "Products" tab at the top of the screen with the shopping cart graphic on it. Once selected, you will have a whole new menu on the left hand side with additional options. On this new menu, select "Taxes" and then "Tax Groups." Inside the "Tax Groups" menu, you will find the "Prevailing Tax Group" option to select. On the "Prevailing Tax Group" page, you will enter in the name for your tax and the rate. After you have done that, you select "+ Create" to lock it in, and then the "Save" icon in the upper right hand corner to save and apply your changes. After this has been completed, you are all set! The system will automatically include the prevailing tax to every transaction.

You can also set up Item Specific Tax Rates for products such as alcohol or cigarettes, which may have separate or different tax rates in your area. To read more or get full step-by-step instructions, follow this link to our support page article.

As always, be sure to keep your browsers on #RevelNation and all our social media to read more Tech Tips every Friday. Happy New Year everyone from you friends at Revel!