Call Sales: +1 (833) 437-3835

Call Sales: +1 (833) 437-3835

Kelly Hogan | August 31, 2022 |

Contactless payment solutions have been a huge trend in consumer restaurant preferences, especially since the onset of the COVID-19 pandemic. In fact, 61% of consumers say they now prefer to make purchases from businesses that accept contactless payments. In order to thrive in the restaurant industry and keep up with this trend, restaurants must adopt a contactless payment strategy.

In this blog post, we will dive into the benefits of contactless payment solutions and the different types of payment solutions your restaurant should have.

Contactless payment technology enables payment transactions without any physical interaction between the payment method and the point of sale (POS). Common ways people use this technology is through contactless debit and credit card exchanges referred to as “tap and pay” transactions or through their mobile wallet with Apple Pay or Google Pay.

Many quick service and table service restaurants are now offering contactless payment methods. Let’s check out why.

Europay, Mastercard and Visa (EMV) chip reader technology now supports contactless solutions. EMV contactless is more secure because it creates a unique, encrypted code for each transaction providing better security.

Consumer demand for contactless transactions surged in response to the COVID-19 pandemic. Even as businesses return to more normal operations post-pandemic, contactless solutions will continue to support safe and convenient on-site experiences, minimizing physical touch in each transaction.

Restaurants can program their POS to have suggested tip amounts or percentages. Digital tipping is so quick and effortless that many consumers are more likely to tip and at a higher percentage. It is a win-win for both the consumer and the restaurant by providing a quick service and higher tip outs for employees.

Some contactless payment solutions, such as self-ordering and self-paying, help restaurants free up staff to focus on more service-oriented tasks. This eliminates the need for back-and-forth communication between servers and customers and allows you to eliminate long lines and serve more guests with fewer staff. Also, contactless payment solutions can reduce labor costs and allow your restaurant to take more orders.

A great payment processing solution accepts a wide variety of payment options, including contactless payment solutions. You will also want your payment terminals to have near-field communication (NFC) capabilities to accept and process contactless credit and debit card transactions. Customers can quickly tap their card on the payment terminal and within seconds their payment transaction is processed and completed!

You will want to look for a POS that can accept Google Wallet or Apple Pay. Millions of users across the world use their mobile phones to hold their credit cards and pay with their phones, smart watches and more. Having a POS that does not support mobile wallets can be a huge disadvantage and lead to thousands of dollars in loss sales and customers.

Many restaurants are embracing contactless payment technology to pay at the table. Customers can either pay through an app, scan a QR code and pay or pay through text message. This helps restaurants turn tables faster and help employees focus on other tasks. It also creates a seamless transaction leaving customers satisfied.

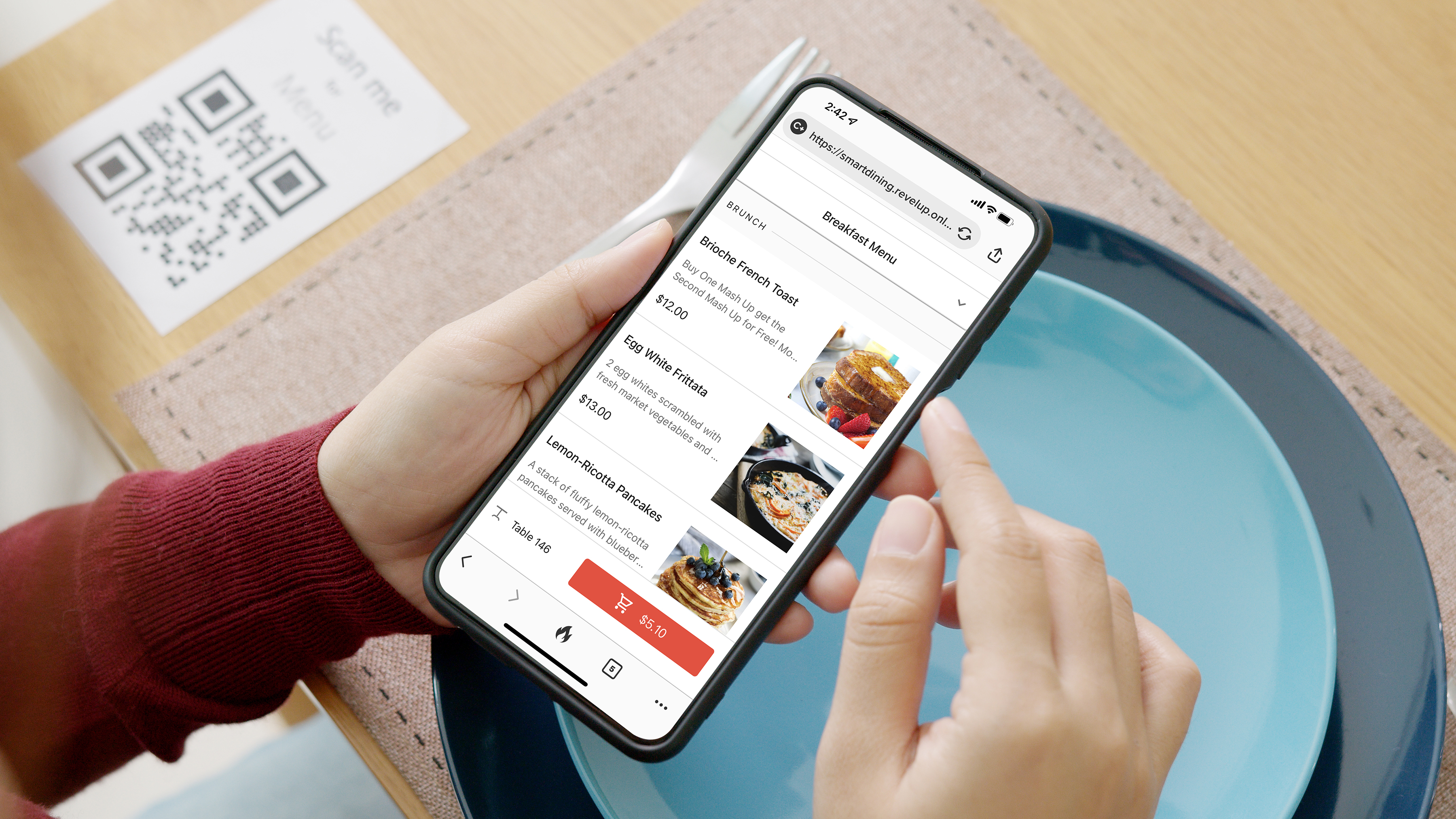

A rising trend since the pandemic has been using QR codes to order and pay. According to a study by Datasential, 58% of consumers would like the option of using a QR code. This is an easy, affordable solution you can implement at essentially no cost. QR codes save you time and money when updating menus as well as help increase revenue by reducing voids or comps because guests can easily submit their own order from their mobile device, minimizing the chance of order entry error.

With operational efficiency, customer convenience and profit optimization in mind, Revel SmartOrder is a solution that allows your customers to quickly order and pay for their meals from their own mobile devices. Easily track guest data, increase average check size, reduce labor costs and provide safe, low contact ordering with Revel SmartOrder.

Revel SmartOrder provides every benefit from offsetting labor challenges to acceptance of multiple payment forms to direct integration to other POS tech solutions and more! With Revel SmartOrder, some merchants saw a 27 percent increase in average check size.

Revel SmartOrder has been used by merchants in various businesses including coffee houses, cafés, and pizzerias, increasing bill sizes and saving on labor costs everywhere it was adopted. With a full-service order-and-pay flow that helps your business streamline the dining experience, Revel SmartOrder can transform your business and increase accessibility for your customers.

Revel has all the contactless payment options for your business. Our in-house payment processing solution, Revel Advantage, accepts mobile payments, contactless debit and credit cards as well as Revel SmartPay—a scan-to-pay or text-to-pay contactless payment option. Contact us today to learn more about all of our payment solutions and make sure your business is ready to accept revenue in any form!